Based on a talk by Salus digital. (Healthcare recruitment company)

You have to plan. Don’t just recruit because someone is putting pressure on you.

Ask yourself – what will you gain by recruiting? -are you ready?

If not the person will leave quickly because they will see there is not structure / role for them and they won’t feel they fit.

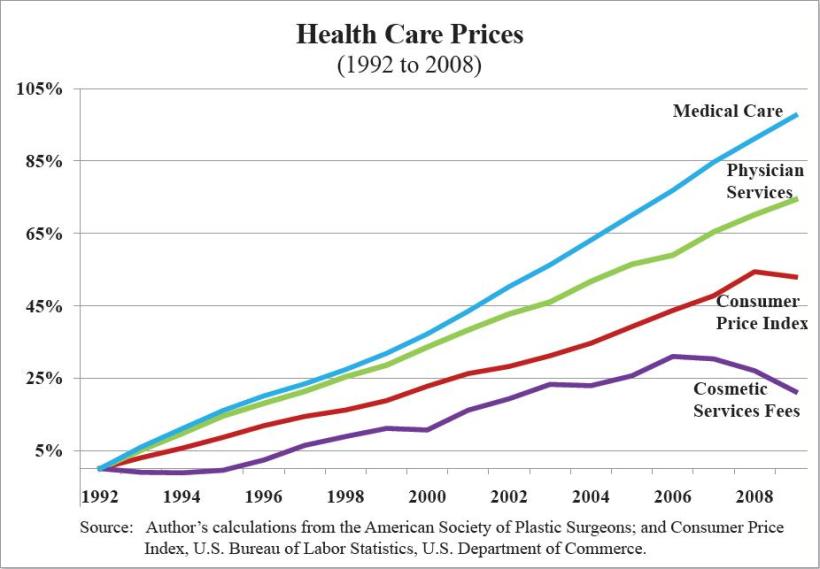

What do you actually need? Do you have a budget for that? Healthtech is an extremely competitive market. If you want someone good you need to pay for it.

Also do you need to be willing to take a risk? or do you want someone defined? The person with the skills you need (particularly if they are soft skills) might not be exactly who you expect.

A £30k employee will actually cost you nearer £50k because of national insurance and various other costs. Do you have enough runway to allow you to see that gain they will bring?

The corporate sector has deep pockets. However, a startup can beat them when it comes to purpose, culture, learning and development and teams.

You need to create a compelling story. What is the EVP (extended value proposition), what are your core values?

You need to stand out from the crowd.

Ask yourself?

Are the core values of the employee in tune with your core values.

Tony Zappos (delivering happiness). He coined the term ‘core values’ and core value proposition. Amazon bought his company for a billion dollars.

Where can you find these people?

You need to attract your own network and exploit network effects. Be careful with those you know personally or are connected to your business somehow. If it doesn’t work out this can be very awkward.

Then you can go to an agency. Go to a specialist. It will cost you money but this will get you access to their network. It will cost you 20-25% of that persons first year of salary!

Advertising is another option – monster etc. LinkedIn. The challenge is to make it specific. Niche skills are important.

The corporate world is full of ‘talent acquisition specialists’ they go through LinkedIn to try and find people and recruit them.

Interview

It’s so important to make a great first impression as a company. That employee will make a decision based on what they see. Have you got the right structure, is there an employee pack with all the info on the background, founders, vision, personal development programme, etc.) That will give an amazing first impression.

The structure of the interview needs to be planned. You have an hour to find out what they have achieved, what figures do they have, examples, test the candidate and let them test you! Sell the opportunity. It’s a buyers market, but don’t oversell it!

What are the timescales? Set them out clearly. When will the first interviews be? When will the second interviews be? Run it professionally and avoid running the risk of losing that person.

Offer your best

Stick with your plan, don’t under offer. If you promise 35k and then offer 30k at the last minute you will demotivate that person and even if you get them they will be demotivated. Offset salary with options. Staggered increases.

Stay in touch, invite them socially to other events. Invest in them before they even get there. Communicate with them and get them involved even if they haven’t yet started. Communicate as much as possible.

Then Celebrate!

Retaining Talent

It is really hard! There is so much going on, so many carrots being dangled everywhere. You have to work at it. Engage them from day one. Induction pack, plan, Zappos offer. Reward achievement, continued professional development, core values. Zappos would offer every new starter £2,000 to leave at the start. 97% don’t take it.

Core Values

Some examples: Create an environment that makes employees feel like an asset, make expectations and goals clear, create an open and honest work environment, provide opportunties to grow and learn, recognise and rewards hard work etc.

The SME advantages

- Corporate obstacles

- Agility

- Low internal politics (this is very attractive)

- Embrace core values

- Achieve the vision

- Sharing success

The culture is often actually real in a startup. These advantages are MASSIVE. Don’t underestimate them.

This was based on a talk by Paul Budd at Salus digital. Talk given at the first ever GIANT health event.

You must be logged in to post a comment.